- The Luminary Network

- Posts

- How a J.P. Morgan Analyst Scaled a YouTube Channel and Navigates Career

How a J.P. Morgan Analyst Scaled a YouTube Channel and Navigates Career

Insights on Director Advisory Services & Board Construction

Hey everyone, lots of gold nuggets in today’s article. I sat down with J.P. Morgan Analyst and YouTuber, Cameron Galbraith (click here for YouTube channel), to discuss his role in Director Advisory Services, his passion for building relationships with top private equity and venture capital firms, and bringing world-class expertise to the board rooms of his clients’ portfolio companies.

Here’s what’s included for today👇

Today’s schedule:

Not subscribed to The Luminary Network? Sign up below to gain direct perspective from the boldest founders, operators, and investors in tech & innovation!

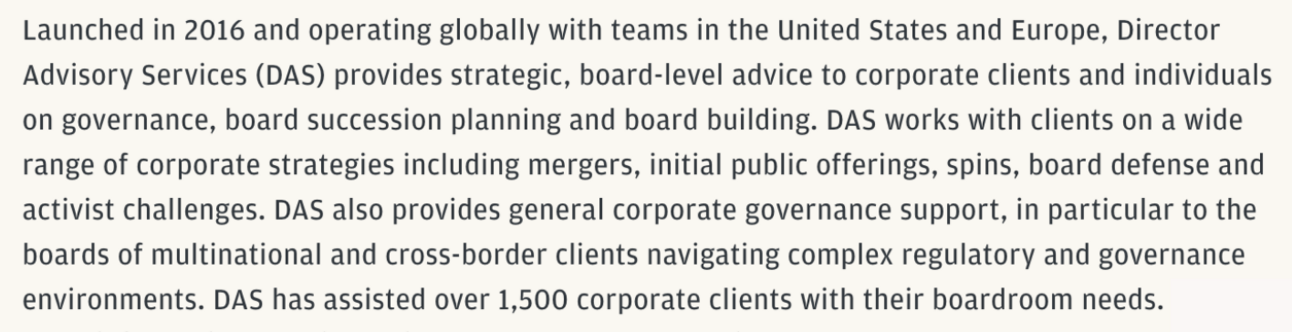

What is Director Advisory Services at J.P. Morgan?

DAS was formed in 2016 by Jamie Dimon and other senior bankers, with the intention to serve as a broker between the firm’s existing relationships with world class expertise, and corporate clients seeking this talent when building out their Boards of Directors.

A few notes on DAS’s footprint:

Key Insights from my convo with Cameron

24 year-old finance professional based in New York City 🗽

Works in a very niche group at J.P. Morgan called Director Advisory Services, where he leads all private equity and venture capital relationships

Former KPMG Consultant, and pivoted into J.P. about 6 months into the role

Started making YouTube videos in 2018 as a freshman at the University of Florida, on topics including college admissions, best practices for excelling in school, internship / full-time recruitment tips, and most recently, thriving as an early career professional.

Insight #1: Take initiative and set yourself apart when exploring a role.

Cameron found DAS through a LinkedIn ‘weekly job suggestions’ email. He was intrigued by DAS, and applied. He reached out to one of the few Associates he could find on LinkedIn, and asked for 10 minutes of his time to learn about the role. He was able to build rapport with the Associate, as they both were avid readers of The Morning Brew. This is a prime example of how a simple connection, no matter how small, can help you make a strong first impression.

Insight #2: Create value at the intersection between your skills and interests, and unmet demand.

Through the DAS lens:

Cameron spoke on the startup culture within DAS (a team of 8 colleagues). “You have the autonomy to be innovative and have permission to find new ways to bring value”. Because he’s passionate about PE and VC, along with the recognition that relationships with PE and VC firms had not yet widely been established by the group, he identified an opportunity to add value while exploring his passions through fostering relationships with and serving private equity and venture capital clients.

Galbraith gets to engage with the top firms by helping their portfolio companies and/or recent acquisitions develop their boards. For example, if a PE firm acquires a semiconductor company, he’ll help them source a director with 30 years of experience in the semiconductor space. Simultaneously, he is building a strong network of investors that he can tap into down the line, should he want to jump into the investing side. Brilliant.

Through the YouTube lens:

To highlight Insight #2 further, Cameron’s first video on YouTube was about getting into the University of Florida, and how he went about it. He found that there wasn’t a lot of authentic content from a student’s perspective at UF. After the first few videos, he received questions from prospective students about the university. This is how he validated the need for this type of content.

He was able to fill this white space by producing more videos, much like he did by taking charge of PE and VC relationships within DAS. Since then, Cameron’s content has flexed and pivoted alongside the new life events he encounters, including strategies for success in college, internship / full-time recruiting, and now finding success as an early career professional. As his audience has grown with him, his content is consistently relevant to their needs.

Insight #3: “You don’t have to wait to have your dream job to DO your dream job.”

Cameron’s childhood dream was to be a talk show host. While conceding that this would likely never happen, he emphasized that you DO NOT need to wait to get your dream job, to DO your dream job. The key point here is you shouldn’t wait to be granted ‘permission’ to follow your passions.

This is the exact approach he took when starting his YouTube channel as a college freshman. He didn’t sit on his hands waiting to become a talk show host, he took the initiative to create his own platform to share meaningful insights with an audience.

This is something I have personal experience with. My dream is to become a software investor. Yes, it is challenging to break in. But there is so much opportunity out there to develop the required skills,before, you get the job.

For me, university provided so many opportunities to engage with my passion for venture. By joining and leading my school’s student-led VC, partaking in a global undergraduate venture capital competition, and interning at a growth equity firm associated with my school, I got to play venture capitalist for three years before I actually became an investor. Though I’m not there yet, I’m building the needed skills to be a value add to a fund down the line.

Bottom line, if you want to do something, go do it. You don’t need to be given permission to do something - all you need is some resourcefulness and tenacity!

Purpose of the Board of Directors: an Overview

My conversation about DAS with Cameron got me thinking: how does a board of directors change as a company scales over time? First, let’s get into the purpose of a Board.

“The CEO fronts the company, leading the team in day-to-day operations to carry out strategy and create value. It’s the board of directors that provides direction and oversight to ensure shareholder and broader stakeholder interests are well looked after.”

In the past, boards were more exclusively focused on maximizing shareholder value. However in recent years, there has been more expectation of firms to positively impact society though environmental, social, and governance (ESG) initiatives. “There is more scrutiny than ever on corporations and the actions they take. Corporations exist with the permission of society, and any sector can be regulated out of business.” Essentially, a company’s board helps ensure that the strategic decisions a company makes align with the the needs of ALL stakeholders (customers, suppliers, community-inhabitants, etc).

The Company Lifecycle and Its Implications on Board Construction

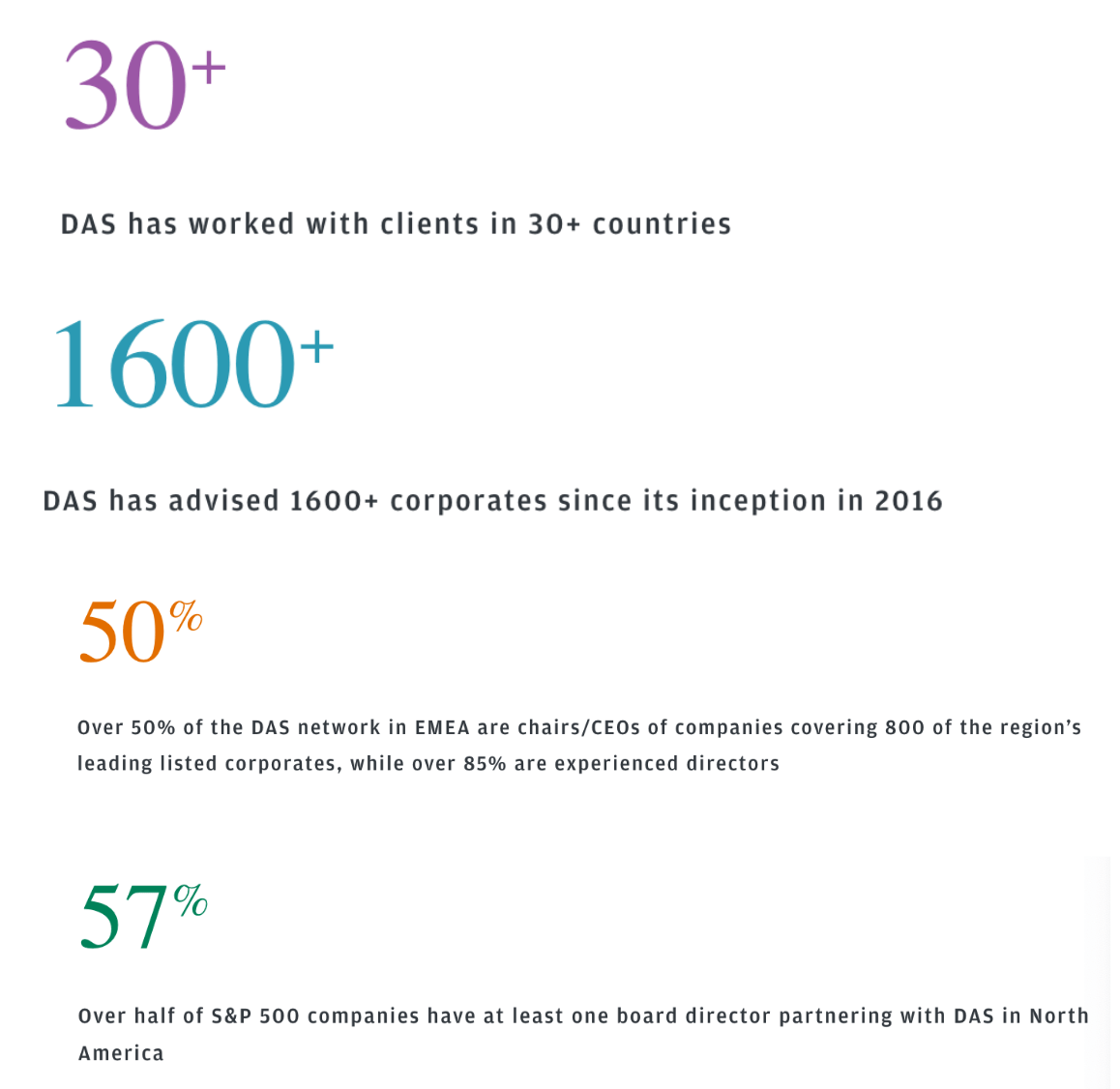

The below graphic, was created using data from 7,200+ VC-backed startups, from a 2021 study by Caltech and University of Michigan professors, that sought to understand the dynamics of a startups’s board construction throughout its lifecycle.

As is noticeably seen, the average number of founders / company executives (orange line) decreases significantly as the number of years since first financing increase, while the average number of VCs (dark blue) increases rapidly over time, and average number of independent directors (black line) also increases at a slower rate. This is understandable, as a company’s priorities pivot as it scales, and additional VCs join the board after subsequent financing rounds.

Source: Drexel University (Note: ‘age’ denoted as years since first financing)

Every company follows roughly the same four stages in its ‘lifecycle’. These include the intro stage (generating early traction and establishing product-market fit), the growth stage (scaling revenue and reducing costs through economies of scale), the maturity stage (revenue and costs level off), and the decline stage. Roughly, each stage of a company’s development will cause its priorities to shift, and thus its board construction.

The Board in Early Stage Companies

In a company’s early stages, the focus is on developing early product-market fit (proving that the market is willing to pay for your offering), establishing your points of differentiation in the marketplace, and overall, establishing the foundational pillars that the company will be built upon as it grows (e.g. the types of people the company hires, and what management systems are used).

While a board of directors isn’t required for any private company, many early-stage startups have them. The reason is that, going back to our previous discussion, a board is often comprised of industry experts that possess many decades of expertise within a specific area. Early stage companies can benefit from direct access to leading experts in their industry.

Investors often assess the strength of an early-stage company’s board, as it is a reflection of the founders’ ability to source and work with subject matter experts. Of course, board members help the company achieve growth milestones, which are immensely important to VCs.

Because there haven’t yet been many rounds of venture financing, the entrepreneurs / company executives hold majority control of the board at this point. It’s also important to note that at this point, the board is a more informal advisory board than a fiduciary Board of Directors. It’s is typically (though not always) comprised of one to three informal mentors with expertise directly pertaining to the company’s vertical, and possibly an independent director (an individual with no interest in the company that can provide an unbiased perspective) that can serve as a tie-breaker in decision-making.

Scale-Up / High Growth Company Board

Once a company has achieved product-market fit, earned its first paying customers, and established its operational processes, its priorities begin to shift toward scaling revenue, while simultaneously reducing costs via economies of scale, increased efficiency in production processes, etc. Additionally, the company may seek to expand beyond its initial core offering and geographic coverage, to offer a wider array of products / services and reach new market segments.

Perhaps the most important shift in board dynamics, is the entrance of additional VCs that join the board after leading the company’s funding rounds. Once the company reaches ~ Series B, the board shifts from entrepreneur / executive majority, to investor majority (there are more investors than members of the company itself on the board). As VCs often seek to make direct impact on the company’s growth, many will require a board seat when leading a financing round.

Pre-IPO Board

If a company reaches a point of development where it is considering going public, a few things need to be implemented in preparation for a possible IPO, often 2 - 3 years in advance.

First, public companies are required to have a board of directors for legal reasons. They must have a few separate committees, as required by the public stock exchanges, including:

Audit Committee: Provides oversight of the financial reporting process, the audit process, the company's system of internal controls and compliance with laws and regulations.

Nominating Committee: Responsible for recommending and approving directors

Compensation Committee: Designs, oversees, and approves executive compensation packages.

As the company eyes an IPO in the near future, the board is responsible for keeping the actions of and decisions of the C-suite in check, to ensure the company grows revenue sustainably, while maintaining margin, and perhaps most crucially, maintaining its public image among public market investors.

That last point, may be the most vital component in whether a later-stage company achieves a strong outcome on the public markets, or achieves a much lesser outcome.

How WeWork → WeCrashed

The negative impact that an ineffective board of directors can have on how a company performs in an IPO is put on display in the Apple TV series, WeCrashed.

WeWork, a shared office space company based in Chelsea, New York City, experienced unprecedented success, having been privately valued at $47 billion in 2019.

In August 2019, the company had announced their intention to IPO, and ironically, selected J.P. Morgan as the lead advisor for the transaction after Jamie Dimon had provided ~$800M in loans to the company.

CEO Adam Neumann “grew WeWork in less than a decade from a single coworking outpost in SoHo into a 12,500-employee company with 500,000 users in 111 cities across 29 countries” (Vanity Fair). The company grew so fast, that it was wildly unsustainable. Regardless, Neumann sought continued growth. Neumann owned 65% of WeWork shares, which prevented the Board from ousting him directly (a fatal issue). Despite serious recommendations from the board to prioritize sustainability and a more modest approach to management, Neumann persisted with his unhinged spending habits and outlandish statement-making tendencies.

By September, the Wall Street Journal had published an article that put WeWork on blast for uncontrolled management after the company had postponed its plans to IPO due the public concern around its detrimental management. Surprisingly, Neumann proposed a vote for himself to voluntarily step down, but by this point, the damage was done.

WeWork, once worth $47 billion, was valued at a comparatively mere $9 billion when it IPO’d via SPAC in 2021.

This is the importance of a board of directors. To ensure that this situation never happens - to ensure the company’s executives are acting in the best interest of all stakeholders and that it maintains a positive image in the eyes of public market investors.

Refer a Friend 🤝🏻

Click the button below to refer a friend if you liked today’s content!

Connect 👋

A HUGE thank you to Cameron for taking the time shed insight on his background at JP Morgan, and how to navigate the early years of your career. Connect with him on LinkedIn, and check out his YouTube channel for more content!

Also, feel free to connect with me on LinkedIn, or via email at [email protected]. I appreciate any and all feedback!

Lots of exciting plans in the works. 🚀

-Jack